By Timon Sisic

Ontario’s greenhouse gas cap and trade regime is not clear enough to be called an aggressive step in the right direction on addressing climate change. As it currently stands, the legislation and regulations are an empty shell that gives the appearance of strong leadership on carbon emission reduction without actually giving guidance to participants or showing the potential to deliver real results in carbon emissions reductions.

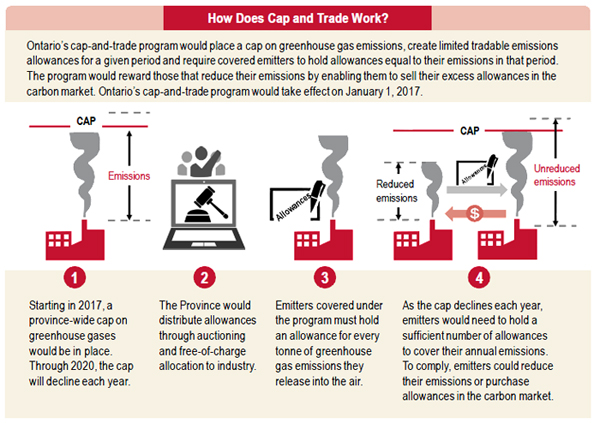

In May of 2016, Ontario passed the Climate Change Mitigation and Low-carbon Economy Act (the Climate Act) and two regulations under it, The Cap and Trade Program (the Cap and Trade Reg) and Quantification, Reporting and Verification of Greenhouse Gas Emissions (the Reporting Reg). As of January 2017, emitters caught under the regulations must bring their emissions levels into compliance and market participants are expected to pounce on the gold-mine that carbon trading is advertised as being.

The basic structure of the Ontario cap and trade regime has been summarized by commentators and the province itself, including the provincial Climate Change Plan.

What I want to point out are two massive question marks left by this system on the dawn of its implementation, especially with respect to the creation of offset credits and early reduction credits.

In much the same way that, as I am writing this, my unpreparedness for exams is impressed on me by the approaching deadlines, the unpreparedness of the cap and trade regime is impressed on me when I put myself in the shoes of a company getting ready to dive into the market in the new year. So let’s dive right in.

Does trading in carbon credits require registration as a trader under either the Securities Act or the Commodity Futures Act (CFA)? Is a carbon credit a security or a commodity? According to a tangential mention in a policy supplement (which is not binding law) by the Ontario Securities Commission, a carbon credit is a commodity. This means that any sort of speculative trading (as opposed to spot-trading) of carbon credits would require registration under the CFA.

At the same time, a cursory look at the Securities Act shows that a carbon credit can also fall within the definition of a security as a “document constituting evidence of title to or interest in… assets”. For this conclusion I do not have the benefit of judicial interpretation or even an OSC policy supplement, but the wording of various sections of the Securities Act itself leads me to conclude that considering a carbon credit a security is not completely absurd. In any case, even experts in securities law cannot give a firm answer to the question of whether a carbon credit is regulated by the Securities Act. The Climate Act and its regulations are silent on this very important issue. One would expect at least a rudimentary clarification of this question in regulations or policy documents when creating a new market. This issue is particularly important considering that Ontario is not acting alone, but rather singing its own praises for partnering with Quebec and California under the Western Climate Initiative to create an efficient and cohesive trading system; one that can work only if we are all on the same page about the legal nature of what we are trading.

http://www.fin.gov.on.ca/en/budget/ontariobudgets/2016/bk4.html

http://www.fin.gov.on.ca/en/budget/ontariobudgets/2016/bk4.html

Then there is the problem of what activities qualify for the creation of carbon credits. While the cap and trade program is often praised for its ability to incentivize innovation in carbon reduction strategies, there is yet to be a specific indication of what initiatives qualify for an offset credit. Quebec and California both have extensive regulations for the protocols that qualify for offset credits in their regimes. While industry participants can try to discern what the approved protocols will be from sources such as statements made by the province that it will be copying some of what California and Quebec are doing, investments of millions of dollars into such initiatives will require more certainty than this type of speculation can provide.

When it comes to early reduction credits, the definitional uncertainty is even greater.

There is little definition as to what will qualify as an early reduction credit; only that it applies to those reduction initiatives that the Minster, in his or her discretion, recognizes are made by “prescribed persons” during a “prescribed period”. Neither the persons nor the period are prescribed in the regulations, nor is an application procedure for qualifying for early reduction credits outlined, despite indications from the province in February, May and November of 2016 that amendments to the regulations would outline early reduction eligibility requirements and the number of credits to be issued. All we know is that the time for creating early reduction credits closed as of May 18, 2016, when the Act received royal assent.

The most recent document provided for comment on the Environmental Bill of Rights Registry promises that offset protocols are coming, along with the development of an offsets registry, Offset Application Forms, Offsets Program Guidance, Verification System and other implementation details. I cannot imagine companies with massive existing infrastructure overhauling their production processes until their lawyers have had the chance to take a good gander at these documents.

Overall, my qualms with this regime boil down to a simple “too little, too late” complaint, with a focus on the lateness aspect.

The dawn of the regime approaches with the New Year and market participants have very little idea where they should be investing and how they should be entering this new market. I fear that by the time all the wrinkles are ironed and the dust has settled, the first compliance period will be all but over, participation will have been minimal and critics will jump on this as further evidence of the failings of market-based emissions regulation.